In the realm of financial analysis, understanding the concept of Days of Working Capital Capsim (DWC Capsim) is crucial for businesses seeking to maximize their efficiency and profitability. This metric provides a comprehensive view of a company’s ability to manage its working capital, offering valuable insights into its financial health and performance.

By delving into the components, calculation methods, industry benchmarks, and strategies to improve DWC Capsim, this guide empowers businesses to make informed decisions and implement effective financial management practices.

Definition of Days of Working Capital Capsim

Days of Working Capital (DWC) Capsim is a metric used to evaluate a company’s financial efficiency, particularly in managing its working capital.

It represents the average number of days it takes for a company to convert its current assets into cash. A lower DWC indicates that the company is efficiently managing its working capital, while a higher DWC may suggest inefficiencies or potential cash flow issues.

Components of DWC Capsim

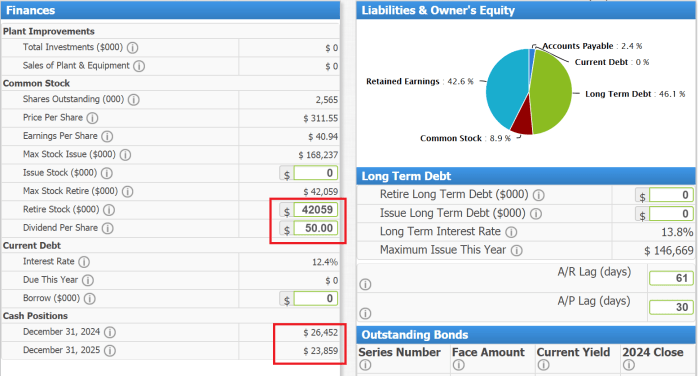

Days of Working Capital (DWC) Capsim is a comprehensive metric that measures the efficiency of a company’s working capital management. It encompasses three key components: accounts receivable, inventory, and accounts payable. Each of these components plays a crucial role in determining a company’s overall DWC.

Accounts Receivable

Accounts receivable represent the amount of money owed to a company by its customers for goods or services sold on credit. Effective management of accounts receivable is essential for maintaining a healthy DWC. A company with a high level of accounts receivable may have difficulty collecting payments from customers, leading to cash flow issues and a higher DWC.

Inventory

Inventory refers to the raw materials, work-in-progress, and finished goods that a company holds for sale. Managing inventory efficiently is crucial for minimizing DWC. A company with excessive inventory may incur high storage and carrying costs, which can significantly impact its profitability and DWC.

Accounts Payable

Accounts payable represent the amount of money that a company owes to its suppliers for goods or services purchased on credit. Effective management of accounts payable can contribute to a lower DWC. By negotiating favorable payment terms and delaying payments within the agreed-upon period, a company can conserve cash and reduce its DWC.

Days of Working Capital Capsim provides an immersive experience to understand the impact of inventory and working capital management on a company’s financial performance. To enhance your understanding, refer to unit 4 learning checkpoint 1 , which offers additional insights and exercises on working capital management.

By completing this checkpoint, you can reinforce your knowledge and apply it effectively in the Capsim simulation, leading to improved financial outcomes.

Calculation of DWC Capsim

Calculating DWC Capsim involves determining the average number of days a company takes to convert its current assets into cash. It provides insights into the efficiency of a company’s working capital management.

Formula and Steps

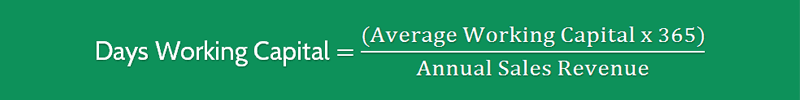

The formula for calculating DWC Capsim is:

DWC Capsim = (Average Accounts Receivable + Average Inventory) / Cost of Goods Sold

365 days

The steps involved are:

- Calculate the average accounts receivable by summing up the accounts receivable balance at the beginning and end of the period and dividing the result by 2.

- Calculate the average inventory by summing up the inventory balance at the beginning and end of the period and dividing the result by 2.

- Divide the sum of average accounts receivable and average inventory by the cost of goods sold.

- Multiply the result by 365 days to convert it into days.

Methods to Determine DWC

There are two main methods used to determine DWC:

- Direct Method:This method uses the formula mentioned above to calculate DWC directly from the financial statements.

- Indirect Method:This method calculates DWC by subtracting the average accounts payable from the average accounts receivable and inventory.

Benchmarking and Industry Averages

Industry-specific benchmarks and averages for Days of Working Capital Capsim (DWC Capsim) provide valuable context for evaluating a company’s performance. Comparing a company’s DWC Capsim to industry standards helps identify strengths, weaknesses, and areas for improvement.

Industry Benchmarks

Industry benchmarks for DWC Capsim vary depending on the sector, business model, and economic conditions. Some common industry-specific benchmarks include:

- Retail: 30-45 days

- Manufacturing: 45-60 days

- Services: 60-90 days

Comparison to Industry Standards, Days of working capital capsim

To compare a company’s DWC Capsim to industry standards, follow these steps:

- Identify the relevant industry benchmark for the company’s sector.

- Calculate the company’s DWC Capsim using the formula provided earlier.

- Compare the company’s DWC Capsim to the industry benchmark.

A company with a DWC Capsim significantly higher than the industry benchmark may have inefficient working capital management practices, while a company with a DWC Capsim significantly lower than the benchmark may be missing out on opportunities to improve liquidity.

Factors Affecting DWC Capsim

Days of Working Capital Capsim (DWC Capsim) is influenced by various internal and external factors that impact the efficiency of a company’s working capital management. Understanding these factors is crucial for optimizing DWC Capsim and improving overall financial performance.

Internal Factors

- Sales Volume:Higher sales volume leads to increased inventory and accounts receivable, potentially extending DWC Capsim. Conversely, lower sales volume can reduce DWC Capsim.

- Inventory Management:Efficient inventory management practices, such as just-in-time inventory and effective inventory control systems, can reduce inventory levels and shorten DWC Capsim.

- Payment Terms:Extending payment terms to customers can increase accounts receivable and lengthen DWC Capsim. Conversely, shorter payment terms can reduce DWC Capsim by expediting cash collection.

- Operating Efficiency:Improvements in operational efficiency, such as reducing production lead times and streamlining processes, can shorten DWC Capsim by accelerating the conversion of inventory into sales.

External Factors

- Economic Conditions:Economic downturns can lead to decreased sales volume and slower payment collections, extending DWC Capsim. Economic growth, on the other hand, can have the opposite effect.

- Industry Dynamics:Different industries have varying DWC Capsim norms. Understanding industry benchmarks and best practices can help companies optimize their DWC Capsim within the context of their industry.

- Government Regulations:Regulations, such as tax laws and environmental regulations, can impact DWC Capsim by affecting the cost of inventory, accounts receivable, and other working capital components.

Strategies to Improve DWC Capsim

Enhancing Days of Working Capital (DWC) is crucial for optimizing a company’s financial performance. Here are some actionable strategies to improve DWC Capsim:

Managing Accounts Receivable

- Offer early payment discounts:Incentivize customers to pay early by providing discounts for prompt payments.

- Set clear payment terms:Communicate payment due dates and consequences for late payments to customers.

- Implement a robust credit policy:Assess customers’ creditworthiness and set appropriate credit limits to minimize bad debts.

- Monitor accounts receivable regularly:Track outstanding invoices and follow up with customers who are overdue on payments.

Impact of DWC Capsim on Financial Performance: Days Of Working Capital Capsim

Days of Working Capital Capsim (DWC Capsim) is a crucial metric that significantly impacts a company’s overall financial performance. By optimizing DWC Capsim, businesses can enhance their profitability and cash flow.

A shorter DWC Capsim indicates that a company is efficiently managing its working capital, reducing the time it takes to convert inventory and receivables into cash. This improved efficiency leads to reduced operating costs, higher profit margins, and improved cash flow.

Improved Profitability

- Lower inventory carrying costs: A shorter DWC Capsim reduces the amount of inventory held, resulting in lower storage, insurance, and other inventory-related expenses.

- Reduced bad debt expense: A shorter DWC Capsim implies quicker collection of receivables, minimizing the risk of bad debts and improving profit margins.

Enhanced Cash Flow

- Increased cash inflows: Optimizing DWC Capsim accelerates the conversion of receivables into cash, leading to a faster inflow of funds.

- Reduced cash outflows: Lower inventory levels and efficient payables management result in reduced cash outflows for inventory purchases and supplier payments.

Limitations and Considerations

While DWC Capsim provides valuable insights into a company’s liquidity and efficiency, it is important to acknowledge its limitations and consider other factors when evaluating financial health.

DWC Capsim primarily focuses on short-term liquidity and does not account for long-term factors that may impact a company’s financial stability, such as debt maturity, capital structure, or investment decisions.

Importance of Other Financial Metrics

To gain a comprehensive understanding of a company’s financial health, it is crucial to consider other financial metrics in conjunction with DWC Capsim. These include:

- Current ratio: Measures a company’s ability to meet short-term obligations.

- Quick ratio (acid-test ratio): A more conservative measure of liquidity that excludes inventory from current assets.

- Cash conversion cycle: Provides insights into how efficiently a company manages its cash flow.

- Profitability ratios (e.g., gross profit margin, net profit margin): Indicate a company’s ability to generate profits.

Question & Answer Hub

What is Days of Working Capital Capsim?

Days of Working Capital Capsim is a financial metric that measures the number of days a business takes to convert its working capital into cash.

Why is Days of Working Capital Capsim important?

DWC Capsim is important because it provides insights into a company’s efficiency in managing its working capital, which is crucial for maintaining financial stability and profitability.

How is Days of Working Capital Capsim calculated?

DWC Capsim is calculated by dividing the average daily working capital by the cost of goods sold and multiplying the result by 365.